By Norman G. Kurland

Guest Opinion published in The Journal of Employee Ownership Law and Finance, published by the National Center for Employee Ownership, Volume 10, No. 1, Winter 1998.

This article proposes a monetary reform, based on the ideas of Louis Kelso, the originator of the ESOP concept, to expand the rate of private sector growth through ESOPs and other credit democratization vehicles. The basic innovation is a refinement of the Federal Reserve discount mechanism under Section 13, para. 2 of the Federal Reserve Act. It aims at radically reducing the cost of capital credit to enable workers and citizens generally to gain equity shares and dividend incomes from the process of financing growth capital, without the use of tax subsidies. It would also reduce the reliance on tax incentives and subsidies for financing expanded ownership, as part of a more comprehensive national economic empowerment strategy of “capital homesteading.

On January 18, 1995, Luis Granados, then chairman of the ESOP Association’s Task Force on Access to Capital for Employee Stock Ownership Plan (ESOP) Creation and Expansion, observed that

(1) The existing legal and economic framework for ESOPs is not nearly favorable enough to achieve the Association’s vision;

(2) it is impossible to change the tax laws to a degree sufficient to achieve that vision;

(3) changes in the capital credit allocation system could achieve that vision; and

(4) there are things the Association realistically can do to plant the seeds to begin putting these ideas into the mainstream of the national debate.’

These observations were sound then and are even more so today. The political climate is growing ever more propitious for ESOP advocates to turn to the Federal Reserve System for giving the ESOP the added boost it needs to lift off from the launch pad. Support is building to reorient ESOP incentives away from a tenuous reliance on tax policy and toward fundamental structural changes.

Another person sharing these insights is Senator Russell Long, perhaps the most informed expert on the limitations of tax policy for promoting ESOPs. Without the enthusiastic leadership and support of the legendary former Chairman of the Senate Finance Committee, the ESOP would have died in the Employee Retirement Income Security Act of 1974 (ERISA). In his keynote address at an ESOP conference at Harvard University 15 years ago, Senator Long stated:

Tax policy alone may not be adequate if expanded ownership is ever to become a reality. It seems to me that we will have to do something on a monetary side as well and I am speaking here in terms of using the government powers through the Federal Reserve Bank and others to see to it that loans are made available on more reasonable terms that help workers acquire capital. [Limited access to capital credit] is why capital ownership in the United States has been concentrated to the point that about 95% of all [individually] held stock is owned by about 15% of our people and very little is held by anyone else.2

The Proposal

In brief, my proposal is this:

The discount mechanism of the Federal Reserve (section 13 of the Federal Reserve Act of 1913) should be reactivated, with appropriate modifications and safeguards, to allow qualified banks and financial institutions to discount “eligible” industrial, commercial, and agricultural paper, representing production-oriented loans to leveraged ESOPs, IRAs, community investment corporations, and similar mechanisms for securing access to low-cost capital credit for broadening capital ownership among workers, area residents, and other non-affluent citizens.

Why Focus on the Federal Reserve?

No other institution has the control over money, credit, and interest rates as that exercised by the Federal Reserve, particularly in the person of Alan Greenspan, Chairman of the Federal Reserve (“Fed”) Board of Governors.3 The Fed Chairman’s enormous influence over the economy is a fact reported in many studies of the Federal Reserve, most graphically in the best-selling book by William Greider, Secrets of the Temple: How the Federal Reserve Runs the Country.4

No other institution has the control over money, credit, and interest rates as that exercised by the Federal Reserve, particularly in the person of Alan Greenspan, Chairman of the Federal Reserve (“Fed”) Board of Governors.3 The Fed Chairman’s enormous influence over the economy is a fact reported in many studies of the Federal Reserve, most graphically in the best-selling book by William Greider, Secrets of the Temple: How the Federal Reserve Runs the Country.4

Greider confirmed what Louis O. Kelso (inventor of the ESOP) and others have observed for years: The Federal Reserve uses its money-creation powers in ways that favor Wall Street over Main Street. This is not due to evil motivations as much as the paradigm from which economists like Greenspan view the world and shape their policies. The processes of creating money and credit and controlling interest rates are little understood by the American people, and hardly more by the Congressional committees to which the Federal Reserve reports. Hence, the activities of the Federal Reserve remain a mystery.

What Is Money?

The money and credit creation process is not as mysterious as most people assume. To understand it, we must first ask the question, “What is money?” Economists have traditionally answered that it is: (1) a medium of exchange, (2) a store of value, (3) a standard of value, and (4) a common measure of value.5 As a lawyer-economist concerned with the impact of contracts and property on the economic system, Louis Kelso delved even further into the nature of money.

Money is not a part of the visible sector of the economy; people do not consume money. Money is not a physical factor of production, but rather a yardstick for measuring economic input, economic outtake and the relative values of the real goods and services of the economic world. Money provides a method of measuring obligations, rights, powers and privileges. It provides a means whereby certain individuals can accumulate claims against others, or against the economy as a whole, or against many economies. It is a system of symbols that many economists substitute for the visible sector and its productive enterprises, goods and services, thereby losing sight of the fact that a monetary system is a part only of the invisible sector of the economy, and that its adequacy can only be measured by its effect upon the visible sector.6

The process of money creation using a central bank (such as our Federal Reserve System) is neither mysterious nor occult. The system was designed to allow the creation or destruction of money as needed by the economy, so that there would never be too little (resulting in deflation) or too much (causing inflation).

The House Banking and Currency Committee, in its widely circulated publication, A Primer on Money (August 5, 1964), noted:

When the Federal Reserve Act was passed, Congress intended [the purchase of “eligible paper”] to be the main way that the Federal Reserve System would create bank reserves…. When this practice was followed, the banks in a particular area could obtain loanable funds in direct proportion to the community’s needs for money. But in recent years, the Federal Reserve has purchased almost no eligible paper (p. 42).

When the Federal Reserve System was set up in 1914 . . . the money supply was expected to grow with the needs of the economy…. It was hoped that by monetizing “eligible” short-term commercial paper, by providing liquidity to sound banks in periods of stress, and by restraining excessive credit expansion, the banking system could be guided automatically toward the provision of an adequate and stable money supply to meet the needs of industry and commerce…. To safeguard their liquidity and provide a base for expansion, the member banks . . . could obtain credit from the nearest Federal Reserve bank, usually by rediscounting their “eligible paper” at the bank-i.e…. selling to the Reserve Bank certain loan paper representing loans which the member bank had made to its own customers (the requirements for eligibility being defined by law). If necessary, the member banks might also obtain reserves by getting “advances” from the Federal Reserve bank (p. 69).

In other words, under a standard central banking system, businesses or other productive enterprises would obtain loans at their local commercial bank. The commercial bank, in a process known as “discounting,” would then sell the qualified loan paper of the business enterprises to the central bank. In the case of the United States, the commercial bank would sell its paper to one of the twelve regional Federal Reserve Banks. To be able to purchase the “qualified paper,” the Federal Reserve would either print new currency or simply create new demand deposits.

As originally intended when the Federal Reserve System was established, this process would create an asset-backed currency that increased as the need for money increased, preventing deflation. As the loans were repaid, the currency would be taken out of circulation, or the demand deposits “erased” from the books. This would remove money from the economy that was not linked directly to hard assets, and would thus prevent inflation.

Although no actual teller’s window exists where commercial banks stand in line to sell loan paper to the Federal Reserve, the transaction is described as taking place at “the discount window.” When the “discount window” is “open,” commercial banks can sell their “qualified industrial, commercial and agricultural paper” to the central bank. When the “discount window” is “closed,” commercial banks must go elsewhere to obtain excess reserves to lend, or cease making loans.

How Has the Discount Mechanism Been Used?

Despite the fact that the discounting mechanism was intended under the Federal Reserve Act of 1913 to be the main means for controlling the American money supply, it has long been abandoned as an integral part of the United States financial system. The discount window has been used to help bail out a few companies or countries considered “too big” or too important to fail.7 Overall, however, the money creation powers of the Federal Reserve have been used to monetize government debt. Since this is not how the system was designed to operate, a number of problems have resulted.

Our economic problems are usually blamed on decisions by Congress or the President, particularly those decisions that result in nonproductive or counterproductive spending and tax policies. Little is said about decisions by the Federal Reserve, many of which, as Louis Kelso and others have pointed out for over 40 years, have been equally counterproductive. Fed policies have added to the problem of government deficits, fueling the growth of the national debt to today’s level of $5.4 trillion (making the United States the highest government debtor in the world). This has artificially and unnecessarily slowed the growth rate of the private sector.

As a result, what Kelso and other ESOP pioneers predicted is becoming increasingly evident:

- Continuing economic disenfranchisement of the American people.

- Low rates of peacetime economic growth.

- Rates of private sector investment far below U.S. potential.

- Excessive use of nonproductive credit in the public and private sectors.

- Downsizing of U.S. companies in competition with foreign companies with lower labor costs.

- Mounting trade deficits in the global marketplace.

- A growing gap in consumption incomes between the wealthiest Americans and ordinary workers and the poor.

- Under-use of human talent and new technologies that could be employed to improve America’s competitiveness in the global marketplace.

My purpose here is to suggest reforms of the Federal Reserve Act that would be fully consistent with its original purposes-to provide an adequate and stable currency and foster private sector growth. These reforms would allow our country to take full advantage of the immense potential of a properly designed central banking system. They would restore a more healthy balance between Main Street and Wall Street, and between the non-rich and the already rich. The proposed reforms would shift the focus of the Federal Reserve from support of public sector growth and indifference to non-productive uses of credit, to support of more vigorous private sector growth, the favoring of productive uses of credit, and broadened citizen access to capital credit.

I will also offer a few minor reforms to Section 13, para. 2 of the Federal Reserve Act that would greatly accelerate the adoption of ESOPs and enormously increase the loan volume and profits of commercial banks that make loans to ESOPs and similar credit democratization vehicles. The reforms would add non-tax incentives in ways that address the concerns of those opposed to abusive ESOPs. They would unite skeptics with supporters on Capitol Hill without sacrificing the current array of tax and credit benefits available to today’s ESOP companies.

I will also offer a few minor reforms to Section 13, para. 2 of the Federal Reserve Act that would greatly accelerate the adoption of ESOPs and enormously increase the loan volume and profits of commercial banks that make loans to ESOPs and similar credit democratization vehicles. The reforms would add non-tax incentives in ways that address the concerns of those opposed to abusive ESOPs. They would unite skeptics with supporters on Capitol Hill without sacrificing the current array of tax and credit benefits available to today’s ESOP companies.

Most important, the proposed new boost to expanded capital ownership for private sector workers and other citizens would not be constrained by Federal Reserve balanced budget restrictions. It would involve no new “tax expenditures” or subsidies. Nor would it rely on existing pools of domestic or foreign wealth accumulations. It would be “A Proposal to Free Economic Growth From the Slavery of [Past] Savings”8-a shift to what Kelso called “pure credit.”

Half the battle is already won. The current Chairman of the Federal Reserve, Alan Greenspan, supports the goal of “broader ownership of capital” and the capacity of well-structured ESOPs to improve productivity. In a letter dated April 7, 1995, to Congressman Bennie Thompson (a Mississippi Democrat representing one of America’s most poverty-stricken areas), Chairman Greenspan agreed that “a broader ownership of capital” was a “worthwhile goal,” and added that “ESOPs have a number of attractive features in addition to a wider ownership of capital.”9 Unfortunately, Mr. Greenspan does not yet see the constructive role the Federal Reserve could play to support these worthy objectives. Indeed, the following proposal could be implemented without abandoning the Federal Reserve’s mandate to stabilize the dollar or work toward maximum rates of productive growth.

Rationale Behind the Proposal: Economic Empowerment as the Ultimate Goal

What is really at issue here? Power. America’s founders clearly recognized that once an individual has enough power, particularly economic power, he or she is free, independent, and can negotiate his or her “sovereignty” in a new “social contract” with that of other “sovereign” individuals. No one can deprive economically independent people of their daily bread. No one can force them to go along with some political or economic agenda against their wills. They can participate fully in economic, social, political, and religious life, or leave it behind, as they choose.

What is really at issue here? Power. America’s founders clearly recognized that once an individual has enough power, particularly economic power, he or she is free, independent, and can negotiate his or her “sovereignty” in a new “social contract” with that of other “sovereign” individuals. No one can deprive economically independent people of their daily bread. No one can force them to go along with some political or economic agenda against their wills. They can participate fully in economic, social, political, and religious life, or leave it behind, as they choose.

Power and Property

Because the best defense against abuse of concentrated power is widely diffused power, what is the best means to make certain that everyone has access to the means to acquire power? How can we ensure that no one can acquire too much power, especially at the expense or exclusion of others? The answer to that has been known for thousands of years. It is only in the last century or so that it seems to have been forgotten.

Power is acquired and maintained through property. As America’s revolutionary forebears realized,

Power and Property can be separated for a time by force or fraud-but divorced, never. For as soon as the pang of separation is felt . . . Property will purchase Power, or Power will take over Property.10

As Daniel Webster said, “power naturally and necessarily follows property.”11 Understanding that, we can then address the issue of how best to accomplish true economic empowerment through a widespread distribution of productive property. The moral necessity of lifting barriers to empowerment between workers and owners was underscored in the famous 1891 encyclical by Pope Leo XIII, Rerum Novarum (“On the Conditions of the Worker”), which stated:

We have seen, in fact, that the whole question under consideration [i.e., the rights of workers] cannot be settled effectually unless it is assumed and established as a principle, that the right of private property must be regarded as sacred. Wherefore, the law ought to favor this right and, so far as it can, see that the largest possible number among the masses of the population prefer to own property.12

The Wage System Is Inadequate

Many people today still cling to the assumption that economic security and income independence are best achieved by high wages and entitlements. They assume that if a worker is paid more, he or she will become financially independent and thus acquire power. This assumption is being daily challenged by the growing insecurity of the American middle-class. Even Ph.D.s and professionals have become increasingly vulnerable to private sector and public sector “downsizing” or to the transfer of their jobs to professionals in India, China, Russia, and other, cheaper labor markets.

Obviously, people who sell their labor must be paid a just wage. However, without even considering here what constitutes a just wage, it is clear that for most of humanity, wages do not bring power or income security, particularly when technology is continually displacing people at their jobs. While capital brings affluence, wages generally bring only inadequate and insecure incomes and growing dependency on others.13

How then, in a high-tech, global economy, is the average person supposed to acquire property, and thus power? Workers will not acquire property by being induced to spend beyond their means, lured by the mix of easy consumer credit and endless advertising. As William Greider points out in his book One World, Ready or Not: The Manic Logic of Global Capitalism,14 economic globalization has increased the power and income gap between wage earners and capital owners.

Nowadays, as technology and cheaper global labor threaten the economic security of American workers, fewer and fewer workers are able to gain even a bare subsistence through wages, much less a property stake. In the United States, labor’s share of aggregate personal income has declined from about 80% in the 1950s to a little over 64% in 1991.15 On a personal level, this translates into a decline in the average hourly earnings for private workers, adjusted for inflation, from $8.03 in 1970 to $7.40 in 1994.16 Stock options, stock purchase plans, and most belt-tightening approaches to broadened capital ownership offer little systemic change for closing the growing income and power gap between labor and capital.

Credit Is the Key to Empowerment

There is a way that people without savings can acquire capital. They can use credit. But they must use the right kind of credit, which is nothing more than the institutionalization of economic promises within a legal system that makes sure that promises are kept. The rich have always used the right kind of credit (in the form of other peoples’ money or government-monetized credit) to accumulate more capital for themselves-and have gotten richer. The poor and the middle class have been left with the wrong kind of credit-consumer credit-and have gotten poorer.

Productive (or “capital”) credit is a good use of credit. Under sound management, a productive asset that is bought on credit is expected to pay for itself. In other words, it is procreative and self-justifying. It does this by using the earnings of the newly created or purchased tools and other assets to pay off the debt. When the debt is fully paid, the owner not only has more assets, but also more capital income. Indeed, capital breeds more capital, especially for current owners.

Non-productive (or “consumer”) credit is a bad use of credit. It supplies money to the borrower to buy things that do not pay for themselves. It reduces future income by the amount of the current purchase and the future interest charges. This kind of credit is expedient, but makes the user poorer.

Yet, strangely, while virtually no one has trouble obtaining consumer credit (thus spending more than they earn), it is practically impossible for most people to obtain capital credit. Most lenders require “collateral” (i.e., existing assets) as the key to accessing a capital loan. The collateralization requirement therefore creates an effective barrier that prevents most people, who have no assets, from ever acquiring capital assets.

For thousands of years, natural law philosophers have acknowledged that everyone should have the right to acquire productive assets. This “right to property” is not limited as are the rights of property, which refer to what you can do with your possessions once you have them. The problem is that few people have the means to exercise the right to property when they lack past savings, sufficient current income, or access to capital credit.

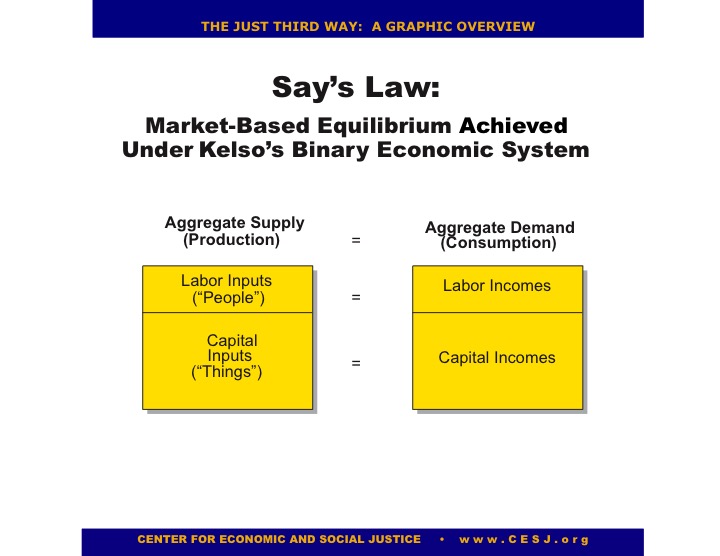

Binary Economies: The Systems Logic” for Spreading Ownership Incomes

The model Kelsonian economy stands in sharp contrast to economies structured to distribute mass purchasing power exclusively through jobs and welfare redistribution. It would distribute an ever-increasing portion of consumer incomes through capital ownership and ownership profits spread directly among all households. It would thus link increases in gross aggregate demand directly with productivity increases belonging to new owners by virtue of their equity holdings in new, expanded, or transferred capital. Existing owners with already large accumulations would no longer be allowed to monopolize access to the equity growth in the economy, but in return would be safeguarded against deprivation or erosion of their property rights in present capital assets. Thus, only rights to acquire future equity opportunities and to accelerated future capital growth rates would be affected.

Long-range ownership planning in an economy built under the Kelsonian binary income distribution system, where free-market dynamics would be allowed to link future changes in productive inputs to future changes in labor and capital out-takes, would create directly the expanded market power for sustaining and justifying vastly accelerated, non-inflationary peacetime growth rates. An argument could be made that a Kelsonian U.S. economy would grow as fast as that of today’s China, and perhaps equal our own World War II growth rates of up to 13% annually. Yet even sustained noninflationary growth of 5% in the U.S. GDP would radically close the widening gap between poor and middle-income Americans and the richest 1%.

Instead of stimulating aggregate demand (i.e., mass purchasing power) artificially through easy consumer credit and government tax, spending, and monetary policies (as Keynes believed necessary to clear the markets in periods of over-production), Kelso’s economic system concentrates on stimulating the supply side of the equation. It would also, however, link new supply directly with new demand. Kelsonian policies are designed to build an expanding productive sector that spreads market-based job incomes and widespread profit distributions to new as well as current owners. This allows the law of supply and demand to create directly the private purchasing power needed to clear the market of future capital goods and consumer goods.

Under a Kelsonian growth strategy, the source of mass production in society — the corporate sector — would become the means of distributing mass purchasing power among all consumers in society. Under the ideal Kelso model, redistribution of income and governmental interferences with the price mechanism in determining wages, prices, and profit levels would become unnecessary.

“Pure Credit”: Society’s Key for Freeing Economic Growth from Past Savings

“Where will the money come from?” is a common reaction to those encountering the Kelsonian model for the first time. In answering this question, it is important to understand why we need “the money” in the first place.

According to the Economic Report of the President, the U.S. economy adds an annual “growth ring” of about $1 trillion in new technology, plant and equipment, new rentable structures, and new infrastructure in both the private sector and in the public sector. This amounts to about $4,000 annually per man, woman, and child in America. As things stand, tbese growth assets will be financed in ways that create no new owners. This is an exclusionary approach to financing capital and private sector growth.

The question then becomes: How can we begin to finance America’s future capital needs in an inclusionary manner? Is there a way to expand the role of the private sector and enable excluded Americans to accumulate enough savings to purchase that growth capital and gain the right to share in profits as owners?

The answer is “pure credit.” “Pure credit” is a civilized society’s mechanism for easing disparities in wealth. The power already exists in the hands of the Federal Reserve Board of Governors, waiting to be used for meeting our projected capital needs and for democratizing the ownership base of the U.S. economy in the process.

“Pure credit” is based upon the legal concept of “promise” and the enforceability of contracts, two main ingredients of a free and orderly economy. Pure credit is nothing more than the power of people (including legal associations of people, such as corporations) to contract freely with one another under a system of law that enables everyone affected by the contract to enforce their rights and claims over property under the contract. It involves elements of volition as well as control. It is limited only to the extent that people, their associations, and government itself make promises they cannot keep. Since promise is the “glue” that holds any society together and determines how confidently people view the future, the making and breaking of promises determines whether that society is strong or weak, orderly or disorderly, growing or disintegrating.

Credit by its very nature is a social phenomenon. Control over money and capital credit will determine in large measure the nature and quality of America’s future technological frontier as well as its future ownership distribution patterns. Because the ownership of productive capital is so crucial to freedom and human happiness, discriminating among citizens as to who has access to capital credit constitutes as gross a violation of equal protection of the laws as discrimination in access to the ballot. Americans are beginning to discover that such a violation of our fundamental constitutional rights is taking place daily on a systematic basis.

This violation of equal opportunity is institutionalized in the present system of corporate finance, and is inadvertently exacerbated by our own Federal Reserve System. Today’s financial system channels capital credit to the rich and ever-more burdensome consumer credit to propertyless workers. It is not surprising that many people who misunderstand the workings of the central bank advocate the abolition of the Federal Reserve rather than its reform.

The way credit is used, the persons to whom it is made available, and the purposes for which it is used are proper subjects of governmental policy. When the “full faith and credit” of government stands behind the nation’s currency and the demand deposits in our commercial banking system, this involves “pure credit” in the ultimate sense. Government, by controlling the total volume of currency and commercial bank credit needed to facilitate economic transactions, controls the direction of private enterprise. Government also has the power to be “lender of last resort” under our Constitution, if that becomes necessary.

When the government misuses its money-creating powers, we have inflation and a breach of one of government’s most important promises to its citizens-that the value of currency will remain constant. When government does not keep this basic promise to its people, all debts are jeopardized, property is arbitrarily redistributed among debtors and creditors, and the trust that holds society together begins to deteriorate. As one 19th-century economist observed:

Confidence and credit are only moral elements in society; they may be said to be, to a great extent, mere matters of opinion; yet their importance in the production and distribution of wealth is so great, that the whole machinery of material production is kept at work, disordered, or paralyzed, according as these principles act in a healthy manner, irregularly, or not at all…. [I]f credit and confidence should be from any cause destroyed, all these resources seem to have lost their virtue, and general distress prevails. Let confidence and credit be restored, and the whole system is immediately set in motion again, and in a very short time general prosperity returns.18

Some have accused the Federal Reserve of being the source of many economic ills; it can also be the source of the cure. The central bank is government’s main instrumentality for controlling the costs and volume of new credit and money extended through the commercial banking system. The Federal Reserve can play a pivotal role in restructuring the future ownership patterns of the economy and stimulating non-inflationary private sector growth while leaving the actual allocation of credit in the hands of commercial bankers.

The Theoretical Foundations for Kelsonian “Pure Credit”

In The Formation of Capital,19 Harold G. Moulton, former president of The Brookings Institution, laid the theoretical foundation for Kelsonian “pure credit” monetary policies. Moulton pointed out that economic growth did not depend exclusively on past accumulated savings, that there need not be a tradeoff between expanded consumption and expanded investment.20 In fact, Moulton pointed out that demand for capital goods is a derived demand-that it is derived from demand for consumer goods, and that the latter depends on consumption incomes.

Hence, concluded Moulton, forcing people to reduce their consumption to purchase new capital assets is counterproductive; it reduces the viability of that investment and other investments, which ultimately depend on consumer demand.21 He then posed the question, “Where could funds be procured for capital purposes if consumption was expanding and savings declining?”

Moulton answered his own question:

From commercial bank credit expansion. Such expansion relieves the possibility of shortage in the “money market” and enables business enterprises to assemble the labor and materials necessary for the construction of additional plant and equipment.22

Most economists assert there can be no growth without savings unless we cut back on consumption. Moulton argued, however, that the real limits to expanded bank credit were physical ones: unexploited technology, unused capital resources and raw materials, an unemployed or underemployed work force, unused plant capacity, and ready markets for new capital goods and new consumer goods. His study of one of the fastest growth periods of U.S. economic history, 1865 to 1895, revealed that while bank reserve requirements remained relatively constant, the volume of outstanding commercial bank credit rose substantially. At the same time, price levels declined for the period by about 65%.23

Moulton also demonstrated that even in periods of great business activity, our productive energies are normally underused; there is always some slack in the system. He proved that we can have rapid growth without inflation. On the other hand, we can also have rising prices alongside recession, as we experienced for the first time in the “stagflation” of 1974. Moulton’s conclusion is worth noting:

[T]he expansion of capital occurs only when the output of consumption goods is also expanding; and . . . this is made possible by the [simultaneous] expansion of credit for production purposes.24

Unfortunately, Moulton failed to carry the connection between expanded bank credit and expanded capital creation to the next logical step: the expansion of the base of capital ownership and capital income distributions as a new, more direct, and more efficient source of mass buying power to absorb future outputs of final consumption goods. Fortunately, Kelso picked up where Moulton left off.

The Discounting of “Eligible Paper”: The Federal Reserve’s Hidden Power to Stimulate Private Sector Productive Growth with Broadened Ownership

Supplying funds to the money market and controlling the cost of these funds through the discount rate has long been recognized as the orthodox instrument of monetary policy. In Lombard Street,25 Walter Bagehot outlined the principles of central banking, arguing that the main function of the Bank of England was to serve as the lender of last resort, mainly by supplying liquidity to a capital-deficient economy through the flexible use of its rediscount powers.

The Two-Tiered Interest Structure: A New Monetary Strategy for Restoring Market Yields on Past Savings While Lowering the Cost of “Pure Credit”

Clearly, the Federal Reserve’s interest policies affect the rate of capital investments. For example, in the 1970s the railroads found that their after-tax earnings on invested capital had declined to 3% or so, while the interest charges they had to pay for capital expansion loans had mounted to 8% and higher. Growth in this energy-efficient industry came to a screeching halt, and would have remained stagnant without massive taxpayer subsidies. The more this industry borrowed, the greater grew its losses.

On the other hand, if interest costs had stayed at 2% or 3%-the “raw cost” of money exclusive of any “inflation premium”-and if regulatory and labor restrictions on profit levels were removed so that railroads could again compete fairly with alternate modes of transportation, railroads would have become profitable and subsidies would have been unnecessary. The same common-sense logic would apply today in the energy field and throughout the competitive sector of the economy.

As noted above, the Federal Reserve currently makes little use of its power to rediscount “eligible paper” held by commercial banks or to make direct loans to banks to meet their liquidity needs in fostering commercial and industrial development. Instead, the Federal Reserve controls the money supply and interest rates through its other main money-creating powers: by its open market purchases of Treasury securities, by altering reserve requirement ratios, and by controlling the “federal funds rate” (the rate at which one bank charges another for borrowed funds). The Federal Reserve allocates 100% of the money it creates to support public sector growth, none to support private sector growth.

An important staff study released in December 1976 by the House Subcommittee on Domestic Monetary Policy, titled “The Impact of the Federal Reserve System’s Monetary Policy on the Nation’s Economy,” recommended a 4% to 6% growth in the M-1 money supply (currency plus demand deposits), “as a foundation for sustained economic growth.” This is about the same as the Federal Reserve’s growth targets back in the summer of 1977 of 4.5% to 6.5%. Note that in 1995 the Federal Reserve lowered its “cap” on U.S. growth rates to 2.5% of GDP.26

This report-which reflects the heavy influence of Milton Friedman on U.S. monetary policy-shares one thing in common with those who advocate expanding the money supply for “welfare state” purposes. The new money supply, under either conservative or liberal game plans, would be pumped indiscriminately into the economy through the economy’s existing “credit irrigation” system. Part of our present credit system channels funds into expanding market-oriented production, but a significant part of the system channels money into non-productive, resource-wasting, and nonmarket-oriented purposes. Thus quality control (in terms of sharply distinguishing between the “productive” versus “non-productive” uses of credit) has not been factored into the strategies of either side of the debate on monetary policy.

Conservatives, of course, would favor closing the non-market-oriented “leaks” in the present irrigation system. Unfortunately, they also ignore the fact that this would channel even more credit into ownership-concentrating modes of capital creation, thereby increasing the political pressure for redistribution that caused the “leaks” in the first place. While favoring private property, monetarists like Friedman offer no solutions to the dangers inherent in a society where the majority of voters own no capital.

What is missing is a refinement in the present irrigation system that would permit increases in the money supply to be channeled more selectively into new private sector plants, equipment, and advanced technology, but through routes that gradually and systematically create new capital owners, thus reducing the pressures for forceful redistribution.

Features of the Proposal

Under a comprehensive, long-range national “expanded ownership” strategy, as in the proposed “Capital Homestead Act”27 advocated by some of the supporters of Louis Kelso’s theories, the key to growth without inflation is the highly selective use of the Federal Reserve’s rediscount powers and control over interest rates. Ideally, the Federal Reserve, in controlling and channeling monetary growth, would differentiate sharply between interest rates on already accumulated savings (i.e., “other people’s money”) and interest rates on newly created central bank credit for stimulating private sector investment growth among new owners (“pure credit”).

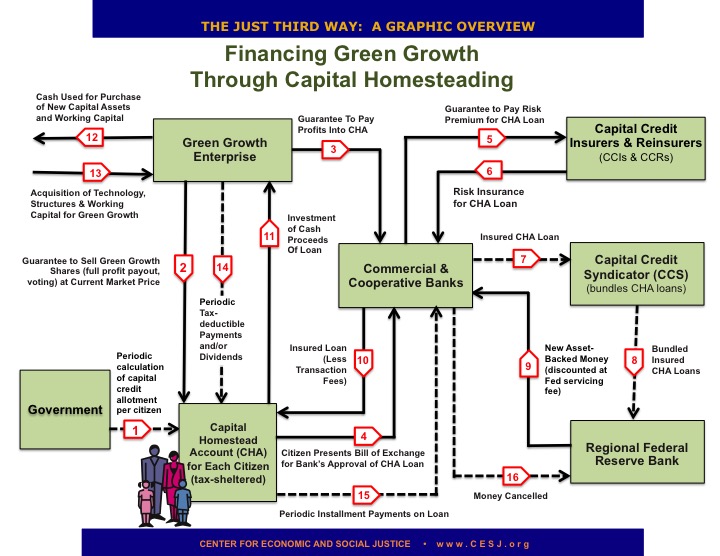

As explained above, the central features of the proposed monetary reforms are based upon classical central banking practices. Figure 1 illustrates the interrelationships between the different elements of the system and how money and credit can be created to bring about noninflationary private sector growth linked to expanded capital ownership.

1. Special Discount Rate

The “discount rate” is the interest rate charged by the Federal Reserve on the loans it makes to its member banks. It is the rate used to calculate the amount “held back” by the Federal Reserve when a commercial bank “sells” loans to the central bank in exchange for new currency or demand deposits. For example, if a bank selling a bundle of loans with a face value of $1 million at the term of one year, had its loans “discounted” by the Federal Reserve at 0.5%, the bank would receive $995,000 in new currency or demand deposits. It would thus be paying to the central bank effective interest of $5,000.

The special discount rate for expanded ownership credit extended by qualified financial institutions would be set at 0.5% or less, whatever is calculated to be the cost of creating and administering new money and credit. This “service fee” would return to the original idea of central bank discounting, where the rate “charged” by the central bank would cover only the administrative costs of the Federal Reserve and other government banking agencies, regulating commercial banks, and other institutions controlling the flow of money and productive credit. It would not allow the Federal Reserve any profits for its role in monetizing expanded citizen access to capital credit.

Qualifying lenders would be free to add their own markup above their cost of money to cover their administrative costs, risk premiums and profit, with overall interest rates set by the market.

2. No Central Bank Allocations of Credit

The fear most often expressed when the reactivation of the discount window is discussed is that the Federal Reserve will begin allocating productive credit to businesses based solely on political considerations. This can be guarded against by implementing a private sector checks-and-balances mechanism. All credit allocations would be handled exclusively by participating banks and financial institutions, subject to market competition, with special safeguards to prevent government allocations of credit or the use of such funds for speculative purposes, consumer loans, or public sector projects. The Federal Reserve properly opposes political allocations of credit, which this proposal is designed to avoid. Local lenders would determine the technical financial feasibility of each loan.

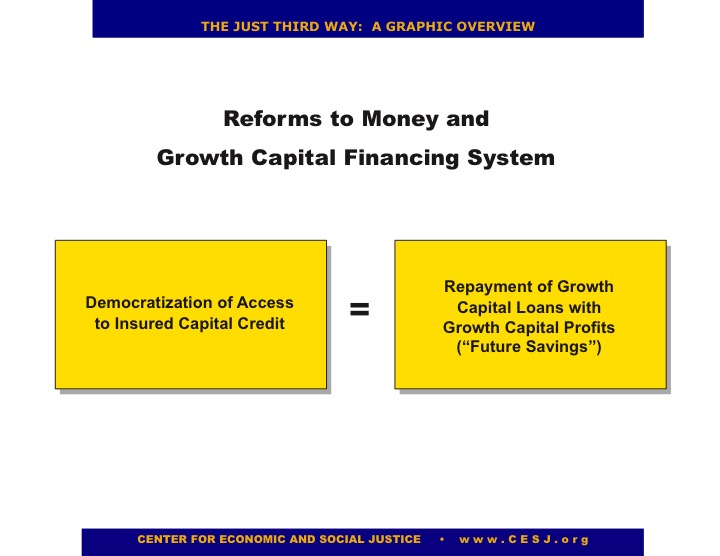

3. Asset-Backed Currency and Collateralization

In conformance with sound central banking practice, all newly created money and bank credit would be asset-backed. Assets would be in the form of pledged shares acquired with the loans discounted at the Federal Reserve, plus guarantees and collateralized assets of the enterprise needing capital. The new capital owners would also be insulated against having their personal assets seized, just as corporate shareholders are today, if future profits do not cover the cost of capital credit.

As a substitute for traditional collateral requirements (a major barrier to expanded ownership among the poor and middle class), Congress and the Federal Reserve would encourage the establishment of commercial loan default insurance and reinsurance pools (like FHA mortgage insurance), funded by the risk premium portion of interest charges. In contrast to the handling of the savings and loan crisis, the full faith and credit of the Federal Government should not stand behind these bank loans or insurers of capital credit in the event of default by companies issuing expanded ownership shares. (In order to encourage responsible lending practices by member banks, capital credit insurance might cover only 80% to 90% of a defaulted loan.)

4. 100% Reserves

Under today’s “fractional reserve” banking, commercial banks can “multiply” the amount of money supplied to them by the central bank. Banks are required to hold as mandatory reserves only a fraction of the cash they take in as deposits. For example, under a 10% fractional reserve requirement, a bank with $1 million in reserves could lend out $900,000, which will be spent and deposited with other banks. As the “excess reserves” (cash in excess of the amount the banks are required to have on hand or on deposit at the Federal Reserve Bank) are lent and re-lent through the banking system (decreasing each time as each bank withholds part of its new deposit to meet its increased reserve requirements), the ultimate effect of a 10% reserve requirement is to increase tenfold the amount of new money available for loans throughout the system.

To avoid the potentially inflationary effect of fractional reserve banking, expanded ownership loans could be made subject to a 100% reserve requirement. This would empower the Federal Reserve with more direct regulatory control over the amount of money in circulation, enabling the central bank to pursue its anti-inflation mandate more effectively. For every dollar of new money created to finance eligible capital loans, the lender would have collateralized or commercially insured loan paper as an equivalent asset on its balance sheets. As the loan is repaid and the new money retired from circulation, the outstanding principal on the lender’s asset would be correspondingly reduced.

5. No More Monetization of Public Sector Deficits

A great deal of new, inflationary money enters the economy because the Federal Reserve purchases government securities in its open market operations. As described above, this effectively “monetizes” government deficits, rather than private sector production. In restoring the original discount powers of the Federal Reserve, Congress may wish to consider eliminating control of the money supply through the Federal Reserve’s Open Market Committee. This would discourage future monetization of Federal budgetary deficits and would require that the Treasury sell securities directly in the capital markets to finance government debt.

6. Eligible Shares

Under Kelsonian monetary reforms, ESOP and other expanded ownership shares that are eligible for Federal Reserve discounting privileges should be “full dividend payout, full voting shares,” with dividends tax-deductible to the corporation and fully taxable as any other source of consumption income to shareholders. The shares should provide workers and other new capital owners with first-class shareholder rights, including the right to vote the shares on all matters subject to a shareholder vote. This reform would broaden and democratize the accountability system of the corporate sector, a goal impossible to achieve through public and private retirement systems or traditional institutional investors. It would also overcome the “closed system” of corporate finance by shrinking retained earnings while offering corporations a cheaper way to combine growth assets with new shareholders.

7. Two-Tier Interest Structure

To shift the economy toward faster growth rates and broader participation in capital ownership, the floor price on the cost of money would be determined by the money’s source, its socially preferred use, and the assets behind the money.

Tier One Interest Rates (“Other People’s Money”)

Yields on already existing investments (“past savings”) should be permitted to rise to whatever levels the money market will permit. Interest rates on Tier One would, therefore, level off at yields on alternative investment opportunities. “Pure credit” would gradually supplant conventional sources of the economy’s expansion capital. Existing savings (to the extent present owners do not convert them into funds for their own consumption) would be freed up and channeled into an expanded funding pool for consumer loans, housing loans, highly speculative ventures, loans for speculating in securities on the open market, small business loans, Treasury bonds, and other risky or inflation-prone purposes. Since this separate reservoir would not increase the output of marketable goods and services to any appreciable degree, its interest rate might contain an “inflation premium” to offset inflationary pressures arising from the use of these funds for stimulating consumer demand or for wasteful and speculative purposes.

Tier Two Interest Rates (“Pure Credit”)

The newly developed “pure credit reservoir” would gradually become the main source for financing the trillions of new equity issuances representing the growth capital required by the economy in the coming decade. The replacement of existing capacity (i.e., plant, equipment, and infrastructure) would continue to be addressed through depreciation accounting, so the financing of growth would not deprive present owners of any property rights in their existing assets.

As explained above, pure credit is based on promise secured by the future profits anticipated from the new investments. Because pure credit would be limited to self-liquidating capital formation and would be cut off by the Federal Reserve whenever the economy operated at 100% of its capacity, “pure credit” is not inflationary. In fact, because low-cost capital credit is geared to increasing production levels without artificially raising labor costs and entitlements, it should bring about lowered overall costs and thus be counter-inflationary. “Pure credit” should never be permitted for consumer financing, government deficits, or speculating in previously issued securities from the open market. These would be financed through the expanded “past savings reservoir.”

8. Economic Empowerment Vehicles Eligible for Pure Credit

Besides the leveraged employee stock ownership plan (ESOP) as the principal pure credit vehicle for people who work in the corporate sector, other such vehicles to expand access to ownership credit would include:

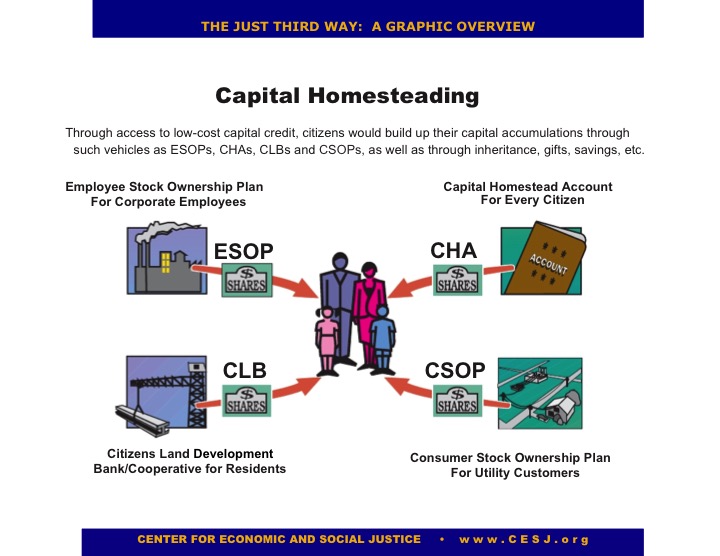

Capital Homestead Accounts (CHAs)

A CHA [referred to in the originally published article as an “Individual Stock Ownership Plan” or “ISOP”] would be a special kind of “leveraged” individual retirement account (IRA). CHAs could be set up at local banks to enable all citizens and families to acquire a diversified portfolio of newly issued corporate shares from registered security dealers, using borrowed money repayable with the full pretax stream of future dividends. By accumulating their own income-producing assets through “capital homesteading,” citizens would gradually reduce their dependency on the near-bankrupt, asset-deficient Social Security and Medicare systems and other government entitlement programs. The advantage of CHAs to growing enterprises is that they would gain an enormous new market for new share issuances to meet their growth requirements, while helping to create future customer power in the bargain.

Citizens Land Banks/Land Cooperatives/Land Development Corporations (CLBs/CLCs/CLDCs)

A CLB/CLC/CLDC [referred to in the originally published article as the for-profit Community Investment Corporation or “CIC’] is a capital credit vehicle that would enable residents of development areas or “new communities” to gain access to equity and real estate profits in locally based, for-profit land acquisition, planning, and development corporations. A variation of the Real Estate Investment Trust (REIT), the CLB is a free market answer to schemes calling for collective community ownership of land. It allows local residents to earn or purchase shares in a for-profit land development corporation and share in appreciated land values and real estate profits that might otherwise flow to outside land speculators.

Consumer Stock Ownership Plans (CSOPs)

A CSOP is a capital credit vehicle for customers of regulated utilities and natural monopolies. Currently utilities and other “natural monopolies” finance growth and new capital equipment through bond issues and preferred shares, floated in traditional money markets, and at fairly high rates of interest. A “CSOP” would allow customers of regulated companies to acquire “leveraged” shares of the utilities in a manner similar to that of participants in an ESOP. It would also give the utility company itself access to low-cost credit, substantially diminishing one of the largest expense items involved in “natural monopoly” finance. Future tax-deductible dividends and patronage rebates would be used to repay the CSOP loans and thereafter be used to reduce the consumer’s utility bills.

9. Risk Insurance as the Solution to the Collateralization Barrier

People without savings or assets who seek a loan to acquire capital assets are faced with a Catch-22 situation. Lenders typically require that a borrower have savings or assets to put up as collateral in the event of loan default. How, then, can someone without savings or assets gain sufficient capital credit to acquire a viable, income-producing capital stake? A Kelsonian monetary system solves that conundrum and the related problem of “risk” by collateralizing bank loans through commercial capital credit insurance.28

The Capital Credit Reinsurance Corporation and Commercial Capital Credit Insurance Companies

A Capital Credit Reinsurance Corporation (CCRC) would be established as a backup insurer of last resort, wholly on a self-financed basis, with no taxpayer funds or government underwriting involved except possibly for start-up organizational funds. Thereafter, its operational costs would be covered by premiums on the insurance programs the CCRC would offer to commercial capital credit insurers of banks and other lenders to ESOPs and other pure credit vehicles.

The major insurance the CCRC would reinsure would be capital credit loan default insurance. This would be similar to that offered by the FHA home mortgage insurance agency and later copied in the private sector by the Mortgage Guarantee Insurance Corporation. The CCRC would charge participating lending institutions an annual voluntary premium-0.5% or higher-to insure an amount between 75% to 90% of their losses on loans offered to ESOP, CSOP, CIC, and ISOP borrowers, and producer and marketing cooperatives.

This would cover the eventuality that companies issuing the shares did not earn enough profits to service the debt. The premium would be included in the annual interest charged by the lenders. Naturally, the sounder the share issuing company, the lower the premium.

Differential risk categories, with adjustable premium rates, could be set up for grouping participating corporations, based on their maturity, their earnings history, the quality of their management, the nature and special risks of their industry, and so on, somewhat along the lines of the bond rating services of Moody’s and Standard & Poor’s.

The CCRC could also offer portfolio reinsurance issued by private insurers, similar to the pension insurance the Pension Guarantee Insurance Corporation offers employers. For an additional premium charged to the new capital owners, commercial insurers would insure assets accumulating in capital homesteading accounts against the “downside risk.” Upon retirement, a worker would thereby be guaranteed a high percentage-say 75% to 90%-of the initial values of all company shares purchased through his ESOP account.

This type of insurance is useful for offsetting the lack of diversification in most ESOPs. This is a common complaint raised against ESOPs, which by design do not have the same level of diversification as within defined benefit pension plans and other conventional retirement programs (or the proposed ISOP described above). If a company failed, capital credit insurance would protect worker-shareholders against the loss of all their retirement assets before they had a chance to diversify. Commercial portfolio insurance could be kept at relatively low premiums if limited to shares in companies that had been profitable for at least three years. The premium costs to cover shares in high-risk, start-up companies would be astronomical compared to those for mature companies with a solid track record of earnings.

Commercial lenders making loans to ESOPs, CSOPs, CICs, and ISOPs (subject to guarantees of high pretax dividend payouts by companies issuing the new equity), would have the option first to arrange for CCRC loan default insurance on the loan paper. (Otherwise, the lenders would be self-insuring the risk of loan default.) Once insured, the loan paper could be brought to the discount window of the nearest Federal Reserve bank. For a discount fee covering the Federal Reserve overhead in administering the “pure credit” system (0.5% or less), new currency would be issued or the bank’s reserves would be correspondingly increased to cover its expanded liquidity needs. No taxpayer funds, no interest subsidies, and no Treasury borrowings would be involved.

10. Bank Interest Rates Under “Pure Credit”

In lending “Tier Two” credit, banks would not be lending “other people’s money.” The “pure credit” interest charges for prime borrowers could therefore be set at 2% to 3%, reflecting the full real costs of expanded bank credit. The cost components for computing these interest rates (totaling 2% to 3%) would be:

- The risk of default, covered by an estimated 0.5% commercial capital credit insurance premium for acquiring full dividend payout shares of low-risk enterprises.

- The Federal Reserve discount rate (the service charge levied on loans to member banks), set at 0.5% or less.

- Lender administrative costs and profits, estimated at 1% to 2%.

Conclusion

In March, 1975, Congress passed House Concurrent Resolution 133, which expressed the sense of Congress:

That the Board of Governors of the Federal Reserve System…

- pursue policies…to encourage lower long term interest rates and expansion in the monetary and credit aggregates appropriate to

- facilitating prompt economic recovery; and

- maintain long run growth of monetary and credit aggregates commensurate with the economy’s long run potential to increase production.

In its 1976 Annual Report, the Joint Economic Committee of Congress stated:

Whatever the means used, a basic objective should be to distribute newly created capital broadly among the population. Such a policy would redress a major imbalance in our society and has the potential for strengthening future business growth.

To provide a realistic opportunity for more U.S. citizens to become owners of capital, and to provide an expanded source of equity financing’ for corporations, it should be made national policy to pursue the goal of broadened capital ownership.

This article is an attempt to reconcile these two expressions of Congressional intent and to make a case for bringing a higher level of economic and social justice to the lives of all Americans. Since justice also mandates that the government not simply confiscate the past savings of others or unilaterally raise wages, the only way remaining for most have-nots to acquire property is through access to capital credit. Fortunately, capital credit can be made available to everyone without taking wealth from anyone.

Since capital credit is a “social good,” arising from agreements between people, Americans, through their elected representatives, have the power to restructure our financial system to extend broad-based access to credit for the purchase of capital assets. This would sever our systemic dependency on the accumulators of past wealth. Our financial institutions are only tools, and as such, should promote our fundamental rights as Americans.

George Mason, Father of the American Bill of Rights, captured the essence of this point when he drafted the Virginia Declaration of Rights, which predated the Declaration of Independence by nearly a month. Section 1 of the Virginia Declaration stated:

That all men are by nature equally free and independent and have certain inherent rights, of which, when they enter into a state of society, they cannot, by any compact, deprive or divest their posterity; namely, the enjoyment of life and liberty, with the means of acquiring and possessing property, and pursuing and obtaining happiness and safety.29 [emphasis added]

Kelso’s proposal to use “pure credit” to convert “waste” into new and more productive technology would help restore Mason’s wisdom about the importance of access to property as a fundamental human right in a free and democratic society. Jefferson’s deletion from the Declaration of Independence of Mason’s call for “the means of acquiring and possessing property” (probably reflecting Jefferson’s moral discomfort with human slavery, a perverted form of property), is one of the most unfortunate omissions in American history.

Economic justice and empowerment for all was the essence of the first American Revolution. Today, the United States can resurrect Mason’s magnificent insight and launch a “Second American Revolution” for the world to emulate, by opening the discount window of the Federal Reserve System to provide every American a capital homesteading stake in our unlimited technological frontier.

Norman G. Kurland, Esq., a lawyer-economist, is president of the Center for Economic and Social Justice. He worked for 11 years with Louis Kelso as his Washington political strategist, helping to draft the initial ESOP laws. He has designed several models and legal systems of expanded ownership, including the first ESOP in a developing country at the Alexandria Tire Company in Egypt. In 1985, President Reagan appointed Mr. Kurland as deputy chairman of the bipartisan Presidential Task Force on Project Economic Justice.

Notes

1 Memorandum to task force invitees from Luis Granados, chairman, “ESOP Association Task Force on Access to Capital for ESOP Creation and Expansion,” January 18, 1995,

2 Senator Russell B. Long, Address at John F. Kennedy School of Government, Harvard University, April 17, 1982.

3 Claudia Rossett, “Greenspan’s Dilemma,” Wall Street Journal, December 12, 1997, A18.

4 William Greider, Secrets of the Temple: How the Federal Reserve Runs the Country (New York: Simon & Schuster, 1988). See also “How the Fed Lets the Deficits Flourish,” Business Week May 20, 1985, by Thibaut de Saint Phalle, author of The Federal Reserve:An Intentional Mystery (1985), as well as Louis O. Kelso and Mortimer J. Adler, The Capitalist Manifesto (New York: Random House, 1958).

5 William Stanley Jevons, “The Functions of Money,” Money and the Mechanism of Exchange (New York: D. Appleton and Company,1898),13-18; see also Paul Samuelson, Economics (New York: McGraw Hill, 1964), 277.

6 Louis O. Kelso and Patricia Hetter, Two-Factor Theory: The Economics of Reality (New York: Random House, 1967), 54.

7 In May 1984, the discount window created $3.5 billion in cash to support a 5-year loan to the troubled Continental Bank of Illinois. On a smaller scale the window was used to bail out the Franklin National Bank. When Freedom National Bank of Harlem was in similar trouble, it was refused similar access to newly created money. See Washington Post, February 20, 1985, D1.

8 The subtitle of Kelso’s second book with Mortimer Adler, The New Capitalists (1961).

9 Letter from Federal Reserve Chairman Alan Greenspan to the Honorable Bennie G. Thompson, April 7, 1995, 3.

10 Benjamin Leigh, in the Virginia Convention of 1820, quoted by Salvador Araneta in Bayanikasan: The Effective Democracy for All (Manila, Philippines: AIA Press, 1976), 57-58.

11 Daniel Webster, Massachusetts Convention, 1820.

12 Leo XIII, Rerum Novarum (“On the Condition of the Working Class”), 1891, § 65.

13 Louis O. Kelso and Patricia Hetter Kelso, Democracy and Economic Power, Extending the ESOP Revolution (Cambridge, Massachusetts: Ballinger Publishing Company, 1986), 7.

14 William S. Greider, One World, Ready or Not: The Manic Logic of Global Capitalism (New York: Simon and Schuster, 1997).

15 United States Department of Commerce, Economics and Statistics Administration, Bureau of the Census, Statistical Abstract of the United States, 1992, 112th Edition (Washington, D.C.: U.S. Government Printing Office, 1992), 434.

16 According to figures released by the Bureau of Labor Statistics for the first half of 1994, reported in The Washington Times, September 24, 1994.

17 For one of the most scholarly presentations of Kelsonian economics, see Robert Ashford, “The Binary Economics of Louis Kelso: A Democratic Private Property System for Growth and Justice” in Curing World Poverty: The New Role of Property (St.Louis: Social Justice Review, 1994). Also see “Kelsonian Monetary Weapons for Fighting Inflation” (Proceedings of the Eastern Economics Association Conference, April 1977), and “Money and Prices: Rapid Growth Without Inflation Under Kelso Plan for Expanded Ownership” (December 5, 1972), two papers by Norman G.Kurland available from the Center for Economic and Social Justice, Arlington, Virginia.

18 Charles Morrison, An Essay on the Relations Between Labour and Capital (London: Longman, Brown, Green, and Longmans, 1854), 200.

19 Harold G. Moulton, The Formation of Capital (Washington, D.C.: The Brookings Institution, 1935).

20 See the standard Keynesian assumption embodied in Paul Samuelson’s Economics, a basic economic textbook, under the heading, “The Need to Forego Present Consumption”: “To the extent that people are willing to save-to abstain from present consumption and wait for future consumption-to that extent society can devote resources to new capital formation.” However, Samuelson then supports Moulton’s conclusions in a footnote: “We shall later see that, sometimes in our modern monetary economy, the more people try to save, the less capital goods are produced; and paradoxically, that the more people spend on consumption, the greater the incentive for businessmen to build new factories and equipment.” [emphasis in original] Economics, p. 47.

21 A critical tenet of Kelso’s binary economics is that the purpose of production is consumption. Within the logic of the Kelsonian economic system, all income (particularly income produced by capital), should be spent for consumption, instead of saving it for reinvestment and using it to increase capital gains (which traditionally have been accorded more favorable tax treatment than dividends). The feasibility of investment, after all, depends on consumption sufficient to buy the goods and services produced by the investment. Hence, where there is a more effective way for financing new capital formation, it makes no sense to force people to reduce their consumption incomes to buy capital. It weakens the feasibility of private sector investments by draining off cash needed to repay the capital acquisition loans. This means that corporate profits, after being used to pay off capital acquisition loans, should be paid out to owners as consumption incomes instead of being used for capital growth. The formation of new capital, under Kelso’s system, should be financed with additional pure credit loans monetized by the central bank, while corporate profits could be used to sustain or even increase consumer demand, thus improving the market picture for the entire private sector.

22 Moulton, The Formation of Capital, 107.

23 Ibid, 87, 116.

24 Ibid, 118.

25 Walter Bagehot, Lombard Street (1873).

26 The 2.5% potentia1 GDP growth target represents a combination of roughly 1.1% annual growth in the labor pool (including the unemployed, underemployed, and dropouts), plus 1.4% annual growth rates in productivity (output per worker, including present capacity utilization rates). Federal Reserve economists suggest that growth levels above 2.5% would be inflationary. The Kelsonian analysis suggests that non-inflationary growth considerably beyond 2.5% is possible. This conclusion is based on the fact that technological and systems changes account for almost 90% of all productivity growth, according to economists John Kendrick and Robert Solow. Kelsonian pure credit reforms could provide funds for financing faster rates of technological growth and draw more underused workers into the labor pool in a manner designed to stabilize fixed labor costs.

27 Norman G. Kurland, “The Capital Homestead Act: National Infrastructural Reforms to Make Every Citizen a Shareholder,” an occasional paper of the Center for Economic and Social Justice (Arlington, Virginia, updated 1999).

For a fuller understanding of the technique of collateralization of bank loans through commercial capital credit insurance, one should read various books and writings by Louis O. Kelso. Another useful source is John H. Miller, ed., Curing World Poverty: The New Role of Property (St. Louis: Social Justice Review, 1994), the Kelsonian “textbook for change” compiled by the Center for Economic and Social Justice. See especially Louis O. and Patricia Hetter Kelso, “Uprooting World Poverty: A Job for Business” (chapter 1); Robert Ashford, “The Binary Economics of Louis Kelso: A Democratic Private Property System for Growth and Justice” (chapter 6); and Norman G. Kurland, “Beyond ESOP: Steps Toward Tax Justice” (chapter 8).

28 George Mason, Section 1 of the Virginia Declaration of Rights, June 12, 1776.