The Global Issue

MIT’s David Rotman calls it a “jobs crisis.” Leading economist Jeremy Rifkin predicted it to be the “end of work.” Hod Lipson of Columbia University calls it “something we as technologists need to start thinking about” (Rotman 2015). Robots and automation are eliminating jobs faster than they are creating them. As workers in all industries, professions, and levels are becoming more vulnerable, massive wealth from technology’s increasing productivity is concentrating in the hands of a few owners and CEOs (Rifkin 1995; Rotman 2015).

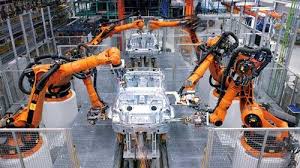

Gone are the days when robots replaced only menial tasks, leaving jobs requiring skilled labor immune to automation displacement. From intelligent algorithms to medical research systems to predictive analytic tools, machines today are increasingly capable of performing high-level human labor with equal or better results (Manyika 2013). The World Economic Forum recently predicted that by 2020, disruptive labor market changes from the rise of robots and artificial intelligence will result in a net loss of 5.1 million jobs (Worstall 2016). Oxford University researchers predict that up to 47% of all jobs in the US are at risk of “computerization” (Pew Research Report 2016).

Gone are the days when robots replaced only menial tasks, leaving jobs requiring skilled labor immune to automation displacement. From intelligent algorithms to medical research systems to predictive analytic tools, machines today are increasingly capable of performing high-level human labor with equal or better results (Manyika 2013). The World Economic Forum recently predicted that by 2020, disruptive labor market changes from the rise of robots and artificial intelligence will result in a net loss of 5.1 million jobs (Worstall 2016). Oxford University researchers predict that up to 47% of all jobs in the US are at risk of “computerization” (Pew Research Report 2016).

“It’s the great paradox of our era,” says Dirk Brynjolfssen of MIT. “Productivity is at record levels, innovation has never been faster, and yet at the same time, we have a falling median income and we have fewer jobs” (Rotman 2013). In this increasingly digital and intertwined world where a few button-pushers may soon replace billions of bread-winners, the benefits from the technological surge have not been enjoyed equally. Harvard economist Richard Freeman describes this as a path spiraling toward “21st-century feudalism in which the owners of capital dominate society” (Freeman 2015).

At 21 years old, I am no Silicon Valley entrepreneur, or Nobel Laureate economist, but with fresh eyes and an open mind I am seeking new approaches that offer me and my eventual children a sustainable future. The economic, political, environmental, and social implications of technological growth are both fascinating and terrifying. Now when my friends and I hear about groundbreaking inventions and increased productivity, we wonder if that means we are going to lose our jobs. Furthermore, technological advances are only exacerbating the ever-widening income gap, and puzzling over the coexistence of extreme poverty with extreme wealth in societies all around the world keeps me up at night.

How can we share more equitably the wealth that technology creates? How can we turn robots into a blessing, not a burden, on our personal incomes and the global economy?

The impact of new technologies on worker well-being and inequality will depend on who owns the robots.

Economic Power to the People

The world’s best minds and scientific experts are trying to solve the “automation versus job destruction” conundrum. Proposed solutions, such as creating artificial jobs, raising the minimum wage, or retraining workers, do not fully address the underlying problem: Too few people own the robots, and this imbalance in ownership will only get worse.

While non-human capital accounts for over 90% of production, only a few fortunate capital owners reap most of the benefits (Kelso 1965). Billions of others live hand-to-mouth under the control of the technological machine owners, in fear of robots replacing their only source of income, namely a job. Recent decades depict a trend of new technologies pouring into the pockets of the very richest, which could turn dystopian visions into reality. However, the machines are merely tools, and if their ownership is more widely shared, the majority of people could use them to increase both their earnings and their well-being (Freeman 2015).

We need a paradigm shift that transcends the pitfalls of current options offered under the conventional capitalist or socialist models. Universalizing access to capital ownership to all citizens is such a revolutionary yet feasible solution. Under reformed tax and monetary laws, citizens could take out loans to purchase shares in new technologies, growing industries, and other wealth-producing capital, with the new capital paying for itself with its own future profits. Essentially, people could borrow to buy shares in the companies that use robots and pay back the loan later with corporate profits generated by the capital they just bought.

Some mechanisms to broaden ownership already exist in employee stock ownership programs, and other practical investment programs are being envisioned and refined to broaden ownership of all forms of capital, including business equipment, automated industries, and other digital technologies (Freeman; Kelso; Ashford and Hall). The logic behind the employee stock  ownership plan (ESOP) used by corporations to empower workers as co-owners could be extended to all citizens. Lincoln’s Homestead Act of 1862 is a historical example of nationwide legislation that could be applied to enable citizens to “homestead” the 21st Century limitless technological frontier (Kurland et al 2004). Equipping every man, woman, and child with a personal ownership stake in the future would empower even the poorest person with a second capital income in addition to a labor income, reducing the need for income redistribution through government.

ownership plan (ESOP) used by corporations to empower workers as co-owners could be extended to all citizens. Lincoln’s Homestead Act of 1862 is a historical example of nationwide legislation that could be applied to enable citizens to “homestead” the 21st Century limitless technological frontier (Kurland et al 2004). Equipping every man, woman, and child with a personal ownership stake in the future would empower even the poorest person with a second capital income in addition to a labor income, reducing the need for income redistribution through government.

Cutting-edge scholars are refining how to implement monetary, tax, and central banking laws that would allow all families to borrow on insured loans to buy stock in new high-tech industries. The newly purchased stock pays for itself out of dividends it generates. The income-generating power of capital is illustrated for example in Bill Gates’ annual $40 billion increase in wealth: Gates’ capital, not his labor, keeps producing income for him even while he sleeps (La Roche 2013).

The concept is simple: Universalizing capital ownership opportunities would cause technological change to empower rather than victimize workers (Freeman 2015; Kurland and Brohawn 2010; Ashford and Hall, 2010). Ownership-expanding policy could eliminate technology-induced loss of income as workers earn more of their income from owning part of the robots and other technologies that replace their jobs (Freeman).

Instead of having underutilized productive capacity, displaced labor, and unsustainable debt-backed money creation, the economy would grow while decreasing widespread inequality. Technology could empower individuals with an independent capital income. Wealth gaps would decrease without depriving current owners of their property rights. The asset-backed money could reduce unsustainable consumer and government debt, and technological progress would thrive because the displaced workers would have an alternate income from dividends.

Own or Be Owned?

Thus, despite revolutionary advances in medicine, telecommunications, transportation, energy systems, and food production that produce privileges like never before, we nonetheless have reason to worry about the global future: Only a fraction of earth’s inhabitants enjoy these modern comforts (UNDP 2003). In addition to displacing jobs, rapid technological advances drive the growing inequality. Concentration of wealth in the hands of a few elite owners stimulates worldwide poverty, terrorism, corruption, violence, human rights abuses, and environmental degradation (World Report 2013). Restructuring the system to democratize economic power through private ownership will decrease cross-border conflict, raise the standard of living for individuals and families, empower individuals to contribute to a free-market system, and more efficiently and justly allocate resources across the globe.

Technological progress is, of course, not inherently evil. Through new financial technologies and redesigned monetary and tax systems, the same forces currently threatening the well-being of billions of non-owning citizens could be used to increase worker well-being and to grow sustainable national economies. If nothing is done to address this global issue, workers will become the objects of charity or government welfare. Or worse, workers will remain under control of those who own the corporations and technology, and CEOs who control workers’ only source of income—wages. Broadening capital ownership will prevent people from becoming subjugated to the machines taking their jobs. Owning the robots is a pragmatic, and necessary solution to prevent becoming controlled—or essentially owned—by a powerful few during this inevitable increase in automation. With bold and innovative thinking, there are available means and realistic strategies to give current and future generations of people an equal opportunity to gain a share in the limitless technological growth frontier.

_________

References

Smith, Aaron. 2016. “Public Predictions for the Future of Workforce Automation.” Pew Research Center. (March): 2-5.

Rifkin, Jeremy.1995. The End of Work: The Decline of the Global Labor Force and the Dawn of the Post-Market Era. G. P. Putnam’s Sons, New York. Print.

Kurland, Norman G. and Dawn K. Brohawn. 2004. “Louis Kelso’s Economic Vision for the 21st Century.” Center for Economic and Social Justice.

Human Rights Watch. 2013. World Report. Printed in the US.

Rotman, David. 2015. “Who Will Own the Robots? MIT Technology Review (June):2-5.

Freeman, Richard B. 2015. “Who Owns the Robots Owns the World.” IZA World of Labor (May): 1-10.

Brynjolfsson, McAfee, and Michael Spence. 2015. “New World Order.” Foreign Affairs.

Manyika, James et al. 2013. “Disruptive Technologies: Advances that will Transform Life, Business, and the Global Economy.” McKinsey Global Institute (May), accessed online on www.mckinsey.com/business-functions/digital-mckinsey/.

La Roche, Julia. 2013. “Here’s How Much 10 of the Richest People in the World Made Per Minute in 2013.” Business Insider (December): 1-2.

Russel, Stuart, Daniel Dewey, and Max Tegmark. 2015. “Research Priorities for Robust and Artificial Intelligence.” Future of Life (December): 1-10.

Luce, Henry R. 1964. “If the Machine Wants Our Jobs, Let’s Buy It. Life (August): 1-2.

Ashford, Nicolas and Ralph Hall. 2011. Technology, Globalization, and Sustainable Development. Yale University Press. Print.

Kurland, Norman G. and Dawn K. Brohawn. 2000. Owners at Work, Ohio Employee Ownership Center (December): 4-8.

Winthrop, Henry. 1966. “The Sociological and Ideological Assumptions Underlying Cybernation.” The American Journal of Economics and Sociology vol. 25, no. 2 (April): 113-126.

Kelso, Louis O. 1965. “Labor’s Untapped Wealth.” Address delivered at the ALPA Retirement and Insurance Seminar (March): Washington, D.C.

United Nations Development Programme (UNDP). 2013. Human Development Report.

Smith, Aaron. 2016. “Public Predictions for the Future of Workforce Automation.” Pew Research Center Report (March).

Worstall, Tim. 2016. “WEF’s Davos Report On Robots, Automation and Job Loss: A Trivial Result Of No Matter At All.” Forbes (January).

Kurland et al. 2004. Capital Homesteading for Every Citizen. Economic Justice Media, Washington, D.C. Print.